Understanding Startup Founder Vesting

Disclaimer: This post discusses general legal issues, but it does not constitute legal advice in any respect. This post is not a substitute for legal advice and is intended to generate discussion of various issues. This post is not to be construed as an offer or a price quote for legal services, the cost of which shall vary. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel. Cara Stone, LLP and the author expressly disclaim all liability in respect of any actions taken or not taken based on any contents of this post. The views expressed herein are personal opinion. Reading, downloading, or covering this article does not create an attorney-client relationship.

Startup founder vesting is one of the most commonly misunderstood concepts in the startup community.

Many people believe that founder vesting means that the founder or other employee earns shares over time. In other words, the belief tends to be, that every year an employee works for the company, they receive new shares until they are fully vested. However, this is incorrect.

The way that the IRS looks at founder vesting is that if the founder is promised 4 million shares in the beginning, but he or she is getting those shares over time, the founder will be taxed for the difference between what the founder pays for the shares, and the value of the shares at the time they receive those shares. This means, if the value of the company’s shares are increasing over time, so is the founder’s tax liability. In the case of a company that is growing quickly, those tax implications can be large for the founder, and it can put the value of the founder’s services in question.

This can put a major financial obligation on the employee receiving the shares. That’s why founder vesting is set up in another way.

Instead, the way that vesting is set up is that the company will issue all of the shares to the employee at once under certain restrictions and the company then has the right to buy back the shares over time.

Let’s look at an example:

Company A hires its founder for 4 million shares on a 4-year vesting schedule. The fair market price of those shares at the time the founder begins is $4.00. On his/her first day, that founder will pay the company $4.00 for his/her 4 million shares. The founder now owns those shares with no taxable income. However, because the shares are subject to a vesting schedule, the $4.00 and the 4 million shares both go into a company escrow account. Then, based on the vesting schedule, the founder receives shares, and the company receives the initial payment over time.

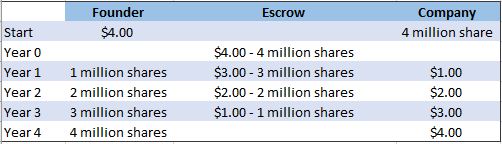

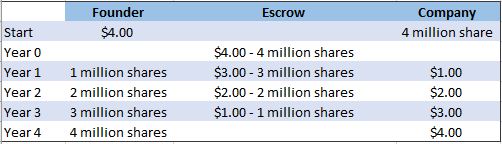

Here is how the schedule might look

After year 1, the founder will receive 1 million shares from the escrow account and the company will receive $1.00 from the escrow account. Even if the value of the $1 million shares had increased to $2.00, the founder would not have taxable income on those 1 million shares. If the founder were to walk away from the company, he or she would own their 1 million shares outright, and the company would be entitled to buy back the other 3 million shares, for the $3.oo they were worth when the founder purchased them.

After year 2, the founder will receive a total of 2 million shares from the escrow account and the company will receive $2.00 from the escrow account.

After year 3, the founder will receive 3 million shares from the escrow account and the company will receive $3.00 from the escrow account.

After year 4, the founder will receive 4 million shares from the escrow account and the company will receive $4.00 from the escrow account. At this time, the founder would fully vested and could walk away from the company without giving up any of his or her shares.

How To Think About Vesting

What vesting really refers to is not the idea of an employee earning new shares over time. Instead, it should be thought of as the company’s right to repurchase shares going away over time. That very simple difference can save an employee unexpected tax consequences if a company is growing quickly and its valuation is increasing.

To summarize, vesting means that the company has the right to buy back shares and that buyback goes away over time, such that an employee is vested. It doesn’t mean that an employee earns new shares over successive periods of time.

Watch the youtube explainer here – https://www.youtube.com/watch?v=NMPgXjQKTbM&t=12s

Other articles you may be interested in:

Taxes on Founder Shares Explained

Preparing For Exit Part 1: Paperwork

Venture Capital Is Data-Driven

Disclaimer: This post discusses general legal issues, but it does not constitute legal advice in any respect. This post is not a substitute for legal advice and is intended to generate discussion of various issues. This post is not to be construed as an offer or a price quote for legal services, the cost of which shall vary. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel. Cara Stone, LLP and the author expressly disclaim all liability in respect of any actions taken or not taken based on any contents of this post. The views expressed herein are personal opinion. Reading, downloading, or covering this article does not create an attorney-client relationship.

Startup founder vesting is one of the most commonly misunderstood concepts in the startup community.

Many people believe that founder vesting means that the founder or other employee earns shares over time. In other words, the belief tends to be, that every year an employee works for the company, they receive new shares until they are fully vested. However, this is incorrect.

The way that the IRS looks at founder vesting is that if the founder is promised 4 million shares in the beginning, but he or she is getting those shares over time, the founder will be taxed for the difference between what the founder pays for the shares, and the value of the shares at the time they receive those shares. This means, if the value of the company’s shares are increasing over time, so is the founder’s tax liability. In the case of a company that is growing quickly, those tax implications can be large for the founder, and it can put the value of the founder’s services in question.

This can put a major financial obligation on the employee receiving the shares. That’s why founder vesting is set up in another way.

Instead, the way that vesting is set up is that the company will issue all of the shares to the employee at once under certain restrictions and the company then has the right to buy back the shares over time.

Let’s look at an example:

Company A hires its founder for 4 million shares on a 4-year vesting schedule. The fair market price of those shares at the time the founder begins is $4.00. On his/her first day, that founder will pay the company $4.00 for his/her 4 million shares. The founder now owns those shares with no taxable income. However, because the shares are subject to a vesting schedule, the $4.00 and the 4 million shares both go into a company escrow account. Then, based on the vesting schedule, the founder receives shares, and the company receives the initial payment over time.

Here is how the schedule might look

After year 1, the founder will receive 1 million shares from the escrow account and the company will receive $1.00 from the escrow account. Even if the value of the $1 million shares had increased to $2.00, the founder would not have taxable income on those 1 million shares. If the founder were to walk away from the company, he or she would own their 1 million shares outright, and the company would be entitled to buy back the other 3 million shares, for the $3.oo they were worth when the founder purchased them.

After year 2, the founder will receive a total of 2 million shares from the escrow account and the company will receive $2.00 from the escrow account.

After year 3, the founder will receive 3 million shares from the escrow account and the company will receive $3.00 from the escrow account.

After year 4, the founder will receive 4 million shares from the escrow account and the company will receive $4.00 from the escrow account. At this time, the founder would fully vested and could walk away from the company without giving up any of his or her shares.

How To Think About Vesting

What vesting really refers to is not the idea of an employee earning new shares over time. Instead, it should be thought of as the company’s right to repurchase shares going away over time. That very simple difference can save an employee unexpected tax consequences if a company is growing quickly and its valuation is increasing.

To summarize, vesting means that the company has the right to buy back shares and that buyback goes away over time, such that an employee is vested. It doesn’t mean that an employee earns new shares over successive periods of time.

Watch the youtube explainer here – https://www.youtube.com/watch?v=NMPgXjQKTbM&t=12s

Other articles you may be interested in:

Taxes on Founder Shares Explained

Preparing For Exit Part 1: Paperwork

Venture Capital Is Data-Driven