Missouri Venture Capital Report: July 2020 Updates

Disclaimer: This post discusses general legal issues, but it does not constitute legal advice in any respect. This post is not a substitute for legal advice and is intended to generate discussion of various issues. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel. Cara Stone, LLP. and the author expressly disclaims all liability in respect of any actions taken or not taken based on any contents of this post. The views expressed herein are personal opinion.

Missouri Companies Pass $2 Billion In Venture Capital Since 2011

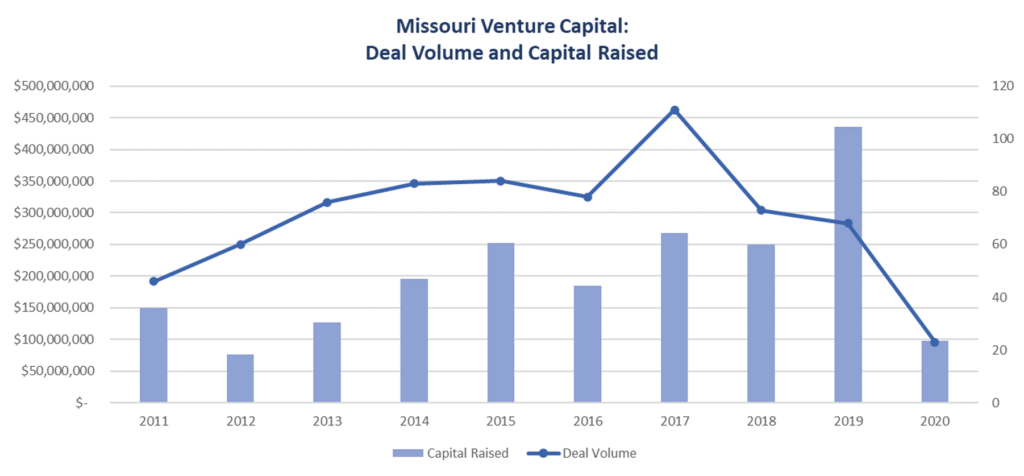

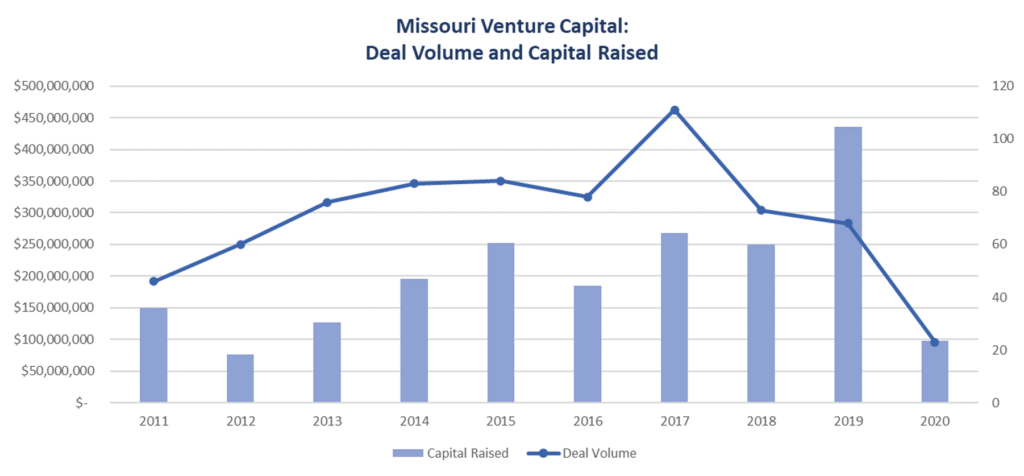

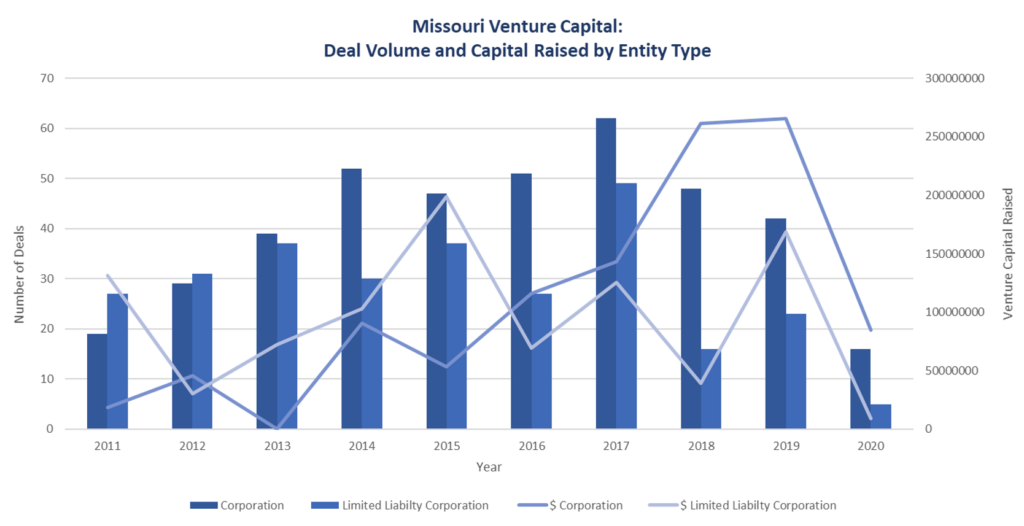

As of our updates on July 1, 2020, Missouri companies exceeded $2 Billion in venture capital since the report started in 2011. 2019 was the highest reporting year for Missouri, with companies raising over $473M across 68 deals. Missouri’s venture capital market has steadily increased since 2011.

In 2020, amid the Covid-19 pandemic, Missouri companies closed just over $97M across 23 venture capital deals. This represents about one-third of the deal volume of 2019 and about a quarter of the capital from 2019. This may be an early indicator that venture capital could slow, however, deal volume was higher in Q2 of 2020 than in Q1. Deal volume tends to vary over time and there are optimistic signs that investors will continue to invest.

Corporation’s Remain the Preferred Choice for Investors

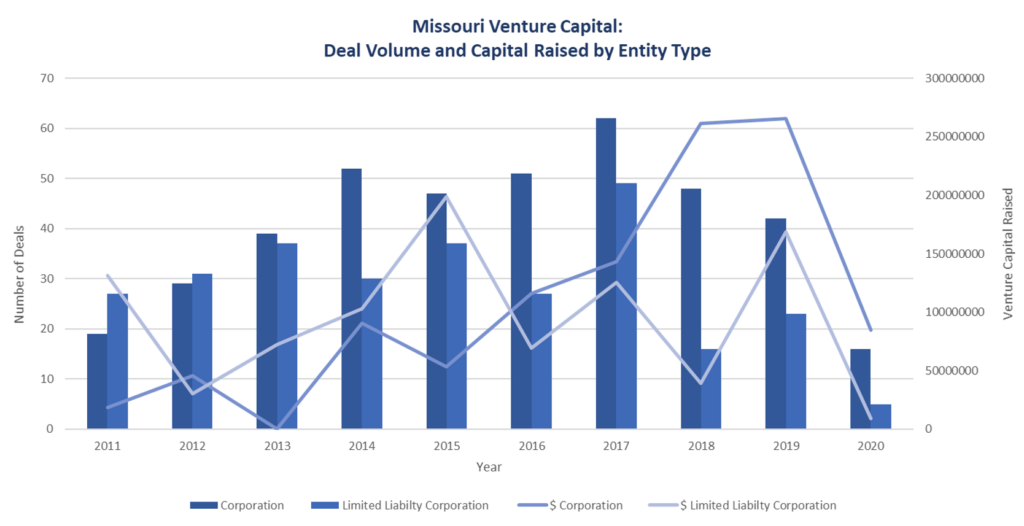

Missouri’s venture capital data reflects the national trend of investor preferences for corporations over LLCs. In fact, since 2016 65% of deal volume and 67% of the capital was raised by corporations. As you continue to slice and dice the data, it becomes apparent that for the majority of industries raising money in Missouri, corporations are the predominant entity type.

Other similarly sized markets, companies raising money are predominantly Delaware corporations. There are several factors to consider when determining a company’s entity type.

SAAS Companies Continue to Lead the Space

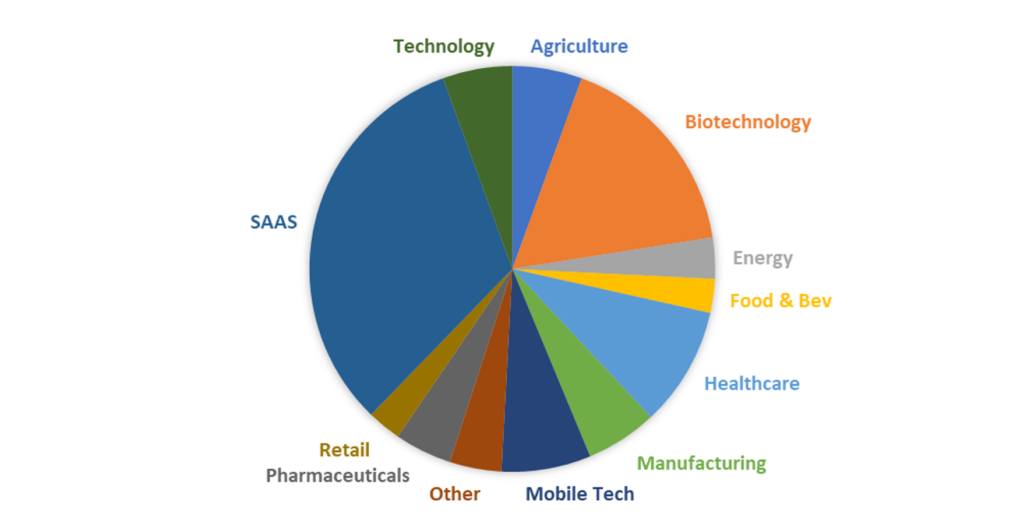

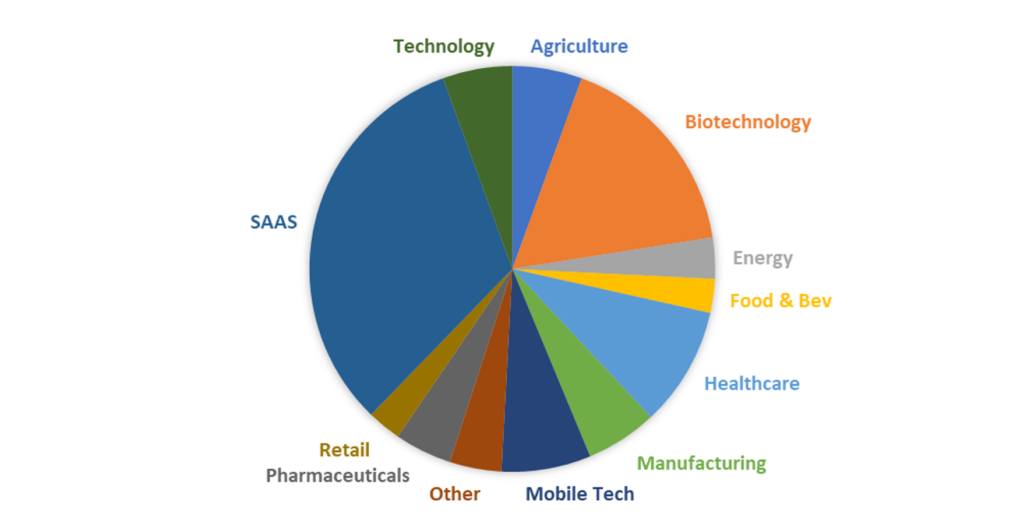

Software as a service (SaaS) companies had the highest deal volume and the highest capital raised since 2011. Throughout our reporting period, software companies, biotechnology companies, and healthcare companies have consistently lead the pack in terms of deal volume and capital raised. Since 2018, SaaS companies have pulled ahead of healthcare and biotechnology companies in both deal volume and capital raised.

Over our reporting period, SaaS companies accounted for 29% of the capital raised ($588M) and 32% of deal volume (266 deals).

Missouri Leads Among Similar Sized Markets

As we look at markets across the country, there is a clear correlation between deal volume and capital raised and population size. Because there is an information void, too many groups look to compare states like Missouri to Silicon Valley or Silicon Alley. Instead, economic leaders should look to economies of similar sizes as a benchmark for market performance and as inspiration for developing communities in their region.

Mark Graffagnini, the Managing Partner of Cara Stone, discusses this and other elements of the Missouri Venture Capital Landscape in the video below.

Learn More about the Venture Capital Landscape in Missouri.

Disclaimer: This post discusses general legal issues, but it does not constitute legal advice in any respect. This post is not a substitute for legal advice and is intended to generate discussion of various issues. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel. Cara Stone, LLP. and the author expressly disclaims all liability in respect of any actions taken or not taken based on any contents of this post. The views expressed herein are personal opinion.

Missouri Companies Pass $2 Billion In Venture Capital Since 2011

As of our updates on July 1, 2020, Missouri companies exceeded $2 Billion in venture capital since the report started in 2011. 2019 was the highest reporting year for Missouri, with companies raising over $473M across 68 deals. Missouri’s venture capital market has steadily increased since 2011.

In 2020, amid the Covid-19 pandemic, Missouri companies closed just over $97M across 23 venture capital deals. This represents about one-third of the deal volume of 2019 and about a quarter of the capital from 2019. This may be an early indicator that venture capital could slow, however, deal volume was higher in Q2 of 2020 than in Q1. Deal volume tends to vary over time and there are optimistic signs that investors will continue to invest.

Corporation’s Remain the Preferred Choice for Investors

Missouri’s venture capital data reflects the national trend of investor preferences for corporations over LLCs. In fact, since 2016 65% of deal volume and 67% of the capital was raised by corporations. As you continue to slice and dice the data, it becomes apparent that for the majority of industries raising money in Missouri, corporations are the predominant entity type.

Other similarly sized markets, companies raising money are predominantly Delaware corporations. There are several factors to consider when determining a company’s entity type.

SAAS Companies Continue to Lead the Space

Software as a service (SaaS) companies had the highest deal volume and the highest capital raised since 2011. Throughout our reporting period, software companies, biotechnology companies, and healthcare companies have consistently lead the pack in terms of deal volume and capital raised. Since 2018, SaaS companies have pulled ahead of healthcare and biotechnology companies in both deal volume and capital raised.

Over our reporting period, SaaS companies accounted for 29% of the capital raised ($588M) and 32% of deal volume (266 deals).

Missouri Leads Among Similar Sized Markets

As we look at markets across the country, there is a clear correlation between deal volume and capital raised and population size. Because there is an information void, too many groups look to compare states like Missouri to Silicon Valley or Silicon Alley. Instead, economic leaders should look to economies of similar sizes as a benchmark for market performance and as inspiration for developing communities in their region.

Mark Graffagnini, the Managing Partner of Cara Stone, discusses this and other elements of the Missouri Venture Capital Landscape in the video below.

Learn More about the Venture Capital Landscape in Missouri.