Covid 19 Paycheck Protection Program Rules Map

Disclaimer: This post discusses general legal issues, but it does not constitute legal advice in any respect. This post is not a substitute for legal advice and is intended to generate discussion of various issues. This post is not to be construed as an offer or a price quote for legal services, the cost of which shall vary. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel. Cara Stone, LLP and the author expressly disclaim all liability in respect of any actions taken or not taken based on any contents of this post. The views expressed herein are personal opinions. Reading, downloading, or covering this article does not create an attorney-client relationship.

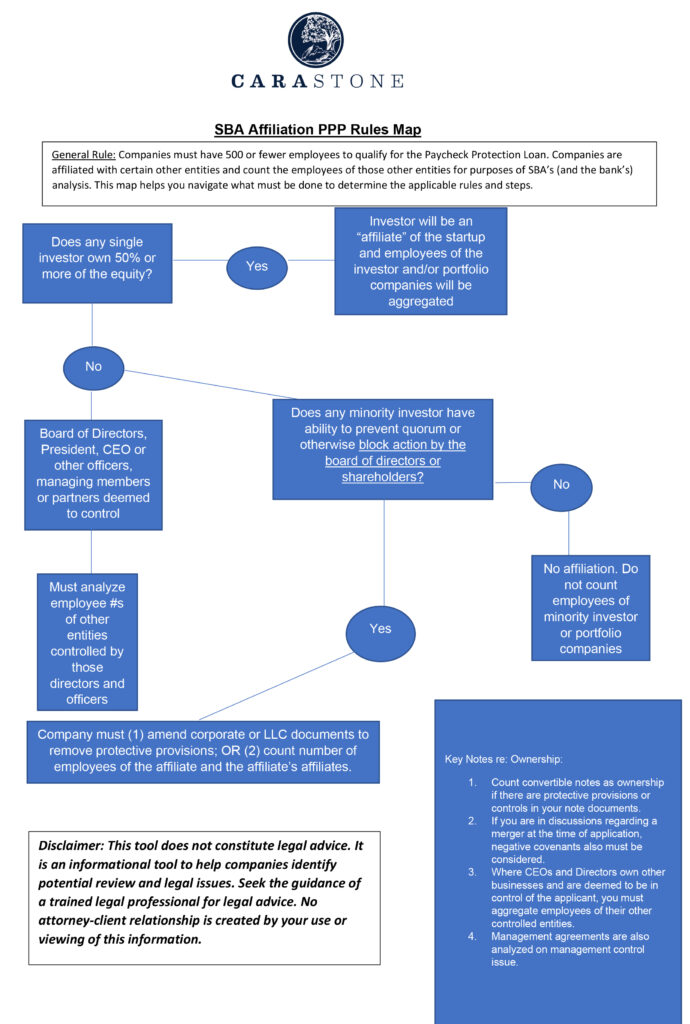

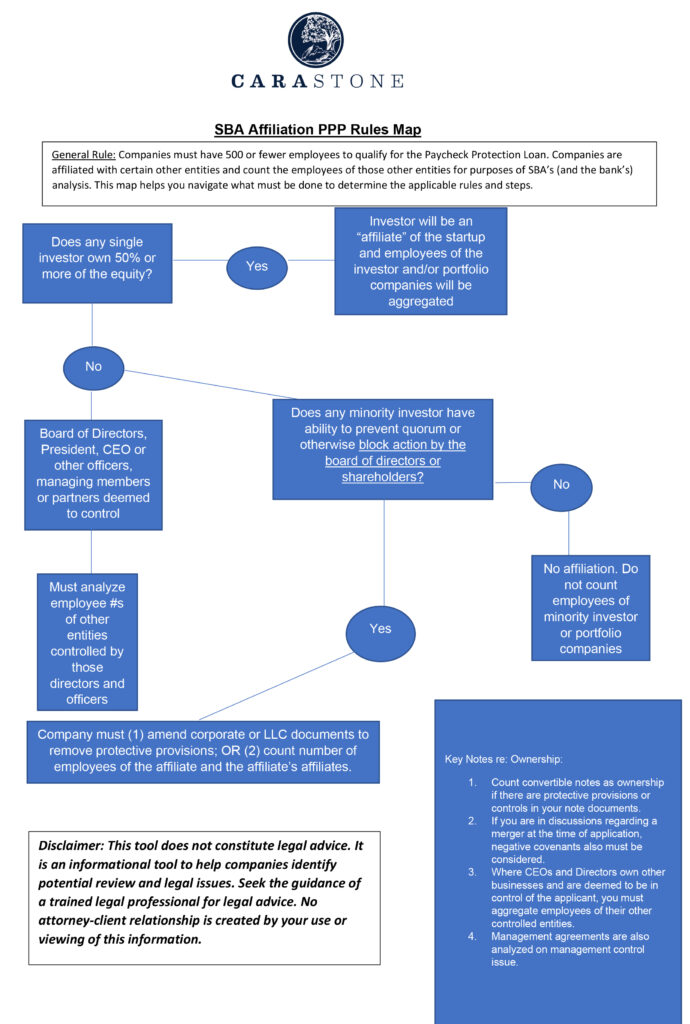

The SBA’s loan program under the Paycheck Protection Program (the “PPP”) poses special issues for companies that have obtained angel and/or venture capital financing. Many of our clients are affected by this and may require an amendment to corporate documents to be eligible to receive funds. We have created a rules map to assist you in determining whether any of your legal documents with investors may need to be amended before your company applies under the PPP. Please contact us if you require assistance or analysis of this issue. Any necessary amendments to corporate documents to protect eligibility should be done as soon as possible, but before your company applies for assistance if affiliation will result in ineligibility.

Disclaimer: This post discusses general legal issues, but it does not constitute legal advice in any respect. This post is not a substitute for legal advice and is intended to generate discussion of various issues. This post is not to be construed as an offer or a price quote for legal services, the cost of which shall vary. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel. Cara Stone, LLP and the author expressly disclaim all liability in respect of any actions taken or not taken based on any contents of this post. The views expressed herein are personal opinions. Reading, downloading, or covering this article does not create an attorney-client relationship.

The SBA’s loan program under the Paycheck Protection Program (the “PPP”) poses special issues for companies that have obtained angel and/or venture capital financing. Many of our clients are affected by this and may require an amendment to corporate documents to be eligible to receive funds. We have created a rules map to assist you in determining whether any of your legal documents with investors may need to be amended before your company applies under the PPP. Please contact us if you require assistance or analysis of this issue. Any necessary amendments to corporate documents to protect eligibility should be done as soon as possible, but before your company applies for assistance if affiliation will result in ineligibility.