3 Key Fundraising Trends from the Missouri Venture Capital Report

Disclaimer: This post discusses general legal issues, but it does not constitute legal advice in any respect. This post is not a substitute for legal advice and is intended to generate discussion of various issues. This post is not to be construed as an offer or a price quote for legal services, the cost of which shall vary. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel. Cara Stone, LLP and the author expressly disclaim all liability in respect of any actions taken or not taken based on any contents of this post. The views expressed herein are personal opinion. Reading, downloading, or covering this article does not create an attorney-client relationship.

Average and median deal size in any given market provides a key metric for companies and service providers in the angel and venture capital world. These numbers help inform how much money a company can seek to raise in a market. As companies develop their fundraising strategy, looking at average and median deal size will help them match capital “asks” to the market in question.

In examining average and median deal size for companies in Missouri, we found several factors that go into determining how much a company is looking to raise including company industry, fundraising stage, where the company is located and more.

Cara Stone’s Venture and Angel Capital Report provides fundraising data and analysis for early-stage companies across the U.S. View the full report at vc.carastone.com.

Below we explore three key trends that Missouri companies, investors, policymakers can take away from the average and median deal sizes trends we’ve identified.

Missouri’s Overall Average and Median Deal Size Remain Consistent

While the average deal size in Missouri rose and fell slightly from 2011 to 2017, overall, the average deal size remained relatively consistent. In 2017, the average deal size was approximately $2.4 million. That figure is comparable to the average deal size of approximately $2.3 million in 2016 and approximately $3 million in 2015.

The median deal size in Missouri has also remained relatively consistent. The median deal size for companies has remained around $500,000 from 2011 to 2017.

This is likely a positive sign for Missouri’s early-stage deal market, given the upward trend in capital raised over the time period. The consistency in average and median deal size seems to indicate that several companies in the market have received funding, rather than the increased capital going to only a few large deals.

The numbers also indicated that companies can find investors at multiple funding levels from smaller seed round, to larger later-stage rounds. As we continue to analyze the data, we will look more specifically at the size of deals and whether company formation appears to be increasing or decreasing.

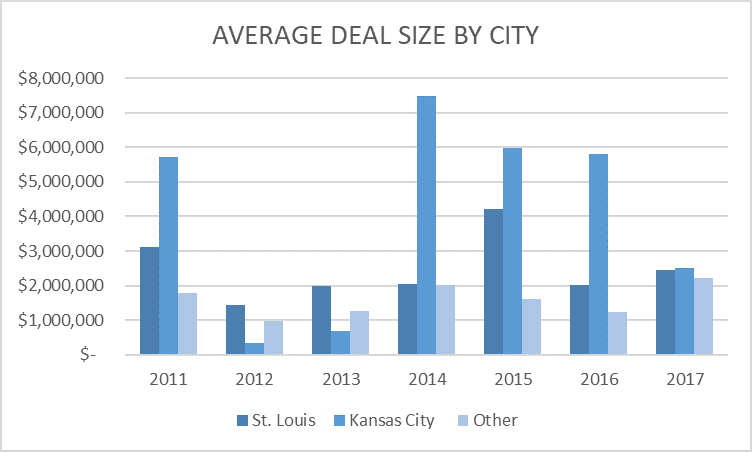

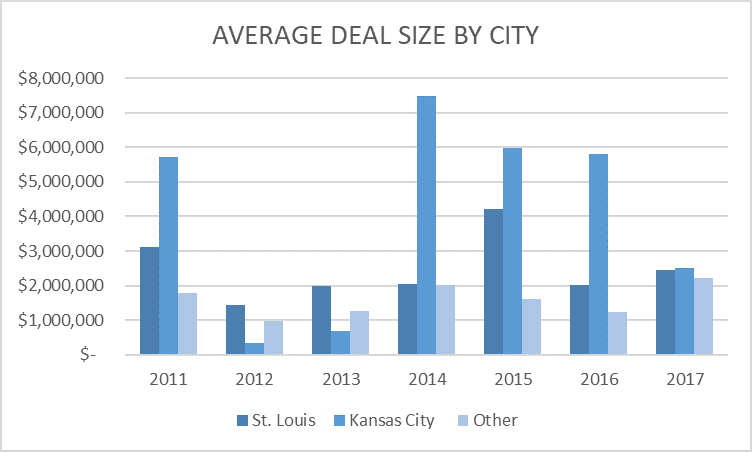

Average Deal Size Fluctuates by City

When we look at average and median deal size by city, we see some fluctuation from city to city. For instance, Kansas City had a higher average deal size than St. Louis or other Missouri cities in 4 of the 7 years we examined. There could be a variety of factors that lead to this conclusion including the industries that tend to cluster in those cities.

Another factor in average deal size by city, could be the number of companies raising money in each city. If St. Louis has more early stage companies which require less capital, that will inherently bring the average deal size down in St. Louis. We will continue to look at the data to evaluate whether this may be the case.

Average Deal Size By Industry Matters

When looking at average deal size, both in Missouri and on a city by city level, the type of company that was funded in a given year seems to have had the most impact on average deal size. For instance, 2014 and 2015 had a similar number of deals. In 2015, however, more biotechnology deals were funded than in 2014. On average, biotechnology deals had the highest average deal size of the industries we examined. Biotechnology companies typically require higher capital investments. This higher capital need is one of the reasons that we see higher capital raised and a higher average deal size in 2015 than in 2014.

Similarly, in 2017, which had the highest number of deals, more SaaS companies raised money than any other industry. SaaS companies had among the lower average deal sizes of the industries we examined. This is one reason we see a lower average deal size in 2017 than in 2015, even though more companies raised money in 2017 than in 2015.

A company’s industry may have been the largest indicator of the size of a company’s round that we examined. Companies can use this information as they plan their fundraising strategy and look for investors who meet their profiles.

See the average and median deals size for every industry we examined here.

Other articles you may be interested in:

Missouri Venture Capital Report

Missouri Industry Analysis

Preparing for Exit Part 1: Good Corporate Hygiene

Disclaimer: This post discusses general legal issues, but it does not constitute legal advice in any respect. This post is not a substitute for legal advice and is intended to generate discussion of various issues. This post is not to be construed as an offer or a price quote for legal services, the cost of which shall vary. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel. Cara Stone, LLP and the author expressly disclaim all liability in respect of any actions taken or not taken based on any contents of this post. The views expressed herein are personal opinion. Reading, downloading, or covering this article does not create an attorney-client relationship.

Average and median deal size in any given market provides a key metric for companies and service providers in the angel and venture capital world. These numbers help inform how much money a company can seek to raise in a market. As companies develop their fundraising strategy, looking at average and median deal size will help them match capital “asks” to the market in question.

In examining average and median deal size for companies in Missouri, we found several factors that go into determining how much a company is looking to raise including company industry, fundraising stage, where the company is located and more.

Cara Stone’s Venture and Angel Capital Report provides fundraising data and analysis for early-stage companies across the U.S. View the full report at vc.carastone.com.

Below we explore three key trends that Missouri companies, investors, policymakers can take away from the average and median deal sizes trends we’ve identified.

Missouri’s Overall Average and Median Deal Size Remain Consistent

While the average deal size in Missouri rose and fell slightly from 2011 to 2017, overall, the average deal size remained relatively consistent. In 2017, the average deal size was approximately $2.4 million. That figure is comparable to the average deal size of approximately $2.3 million in 2016 and approximately $3 million in 2015.

The median deal size in Missouri has also remained relatively consistent. The median deal size for companies has remained around $500,000 from 2011 to 2017.

This is likely a positive sign for Missouri’s early-stage deal market, given the upward trend in capital raised over the time period. The consistency in average and median deal size seems to indicate that several companies in the market have received funding, rather than the increased capital going to only a few large deals.

The numbers also indicated that companies can find investors at multiple funding levels from smaller seed round, to larger later-stage rounds. As we continue to analyze the data, we will look more specifically at the size of deals and whether company formation appears to be increasing or decreasing.

Average Deal Size Fluctuates by City

When we look at average and median deal size by city, we see some fluctuation from city to city. For instance, Kansas City had a higher average deal size than St. Louis or other Missouri cities in 4 of the 7 years we examined. There could be a variety of factors that lead to this conclusion including the industries that tend to cluster in those cities.

Another factor in average deal size by city, could be the number of companies raising money in each city. If St. Louis has more early stage companies which require less capital, that will inherently bring the average deal size down in St. Louis. We will continue to look at the data to evaluate whether this may be the case.

Average Deal Size By Industry Matters

When looking at average deal size, both in Missouri and on a city by city level, the type of company that was funded in a given year seems to have had the most impact on average deal size. For instance, 2014 and 2015 had a similar number of deals. In 2015, however, more biotechnology deals were funded than in 2014. On average, biotechnology deals had the highest average deal size of the industries we examined. Biotechnology companies typically require higher capital investments. This higher capital need is one of the reasons that we see higher capital raised and a higher average deal size in 2015 than in 2014.

Similarly, in 2017, which had the highest number of deals, more SaaS companies raised money than any other industry. SaaS companies had among the lower average deal sizes of the industries we examined. This is one reason we see a lower average deal size in 2017 than in 2015, even though more companies raised money in 2017 than in 2015.

A company’s industry may have been the largest indicator of the size of a company’s round that we examined. Companies can use this information as they plan their fundraising strategy and look for investors who meet their profiles.

See the average and median deals size for every industry we examined here.

Other articles you may be interested in:

Missouri Venture Capital Report

Missouri Industry Analysis

Preparing for Exit Part 1: Good Corporate Hygiene